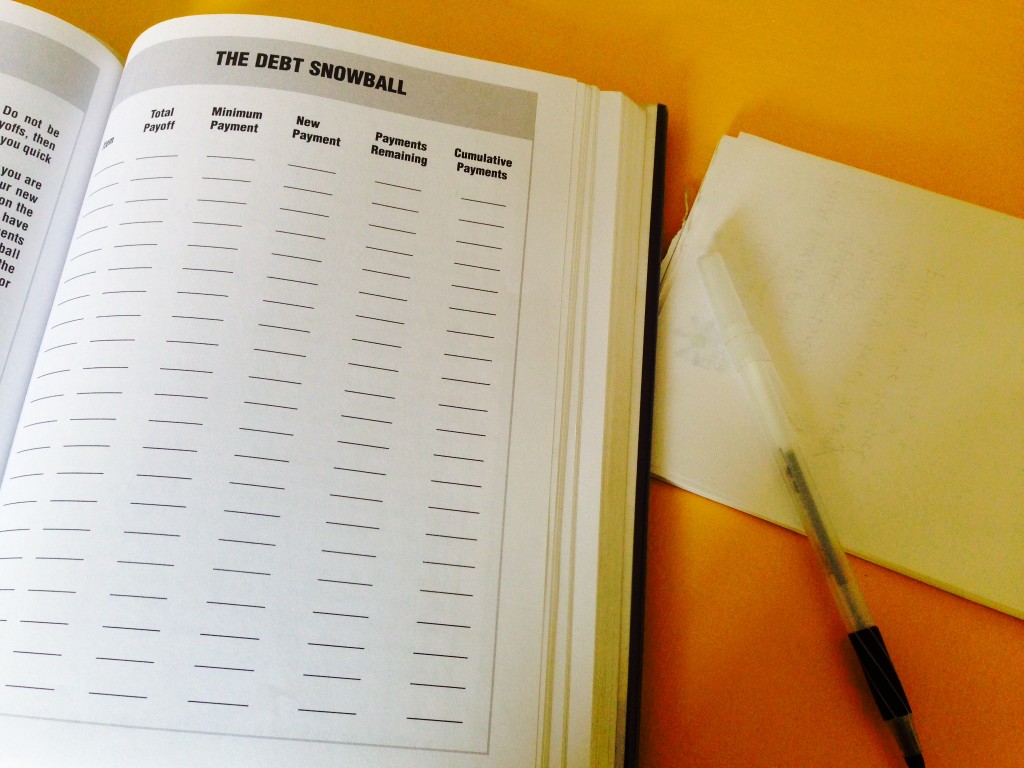

My recent visit to the Golden Public Library had me giddily walking home with an armload of financial advice from Mr. Dave Ramsey and others; folks who’ve followed the Debt Snowball Method and have had great success with the program, and incredible stories to share. These reads have kept me motivated and inspired to continue tackling our debt, one baby step at a time.

this is a great book that references a lot of material from Dave’s, The Total Money Makeover. Both are easy reads; I recommend checking them out at your nearest public library!

As May comes to an end, I eagerly look forward to recalculating our money owed and making any necessary alterations to our budget. As of late, we’ve made excellent progress both in paying a fair amount toward our car loan and not overspending for the month. I won’t lie, adhering to an even stricter budget than before has been challenging. We are constantly reflecting on our finances and making better decisions about where our money goes. In keeping with our goal, purchasing a tasty brew or visiting a cozy coffee shop can wait, albeit sometimes difficult to say no to. Frosty beverages and a fresh pot of coffee are awaiting us at home, and much less expensive. This mindset has great reward, in which we’ve already experienced within these first few weeks of our ‘financial makeover.’

I’ve also been contemplating a few other steps that Dave swears by. I am still a bit hesitant to try them, but from my readings, I know that it has worked for many others. According to Dave, cash is best. If you don’t have the cash to purchase that new computer or that fancy coffee maker, don’t buy it. Instead, Dave strongly suggests putting money aside and saving for those ‘must-have’ items. He employs a no-credit card approach too, which I love and am also secretly trying to warm up to.

We currently have one credit card. To avoid a balance or any interest charged, we pay it off in full at the end of each month. We use it wisely and only spend what we have available in our checking account. So, why not just use a debit card?

Good question. Having a credit card seems safe. It’s comfortable. Closing something that we manage relatively well seems silly, but I also agree with Dave. Credit cards are messy and can get ugly if they aren’t managed properly. Emergencies are bound to happen and credit cards can too easily accommodate those stressful financial situations. On the other hand, I do believe that if we can efficiently budget our finances, we too, would have enough in either account to survive those unexpected emergency expenditures.

Back to Dave’s ‘cash is best’ motto. As a final piece to his program, Dave also teaches his clients about the envelope system. With it, Dave has an envelope for each category that he spends his money on. For us, these envelopes would most likely be categorized by the following: food, rent, gas, miscellaneous, health care, beer and phones. Each month, we would put our allotted monies in to these envelopes and only spend the cash enclosed in each envelope. Once the cash is gone, it’s gone. Brilliant, right? Seemingly, this method sounds great and a sure way to keep from overspending each month. Because we are so fanatical about organizing and budgeting, I think this system would fit perfectly in our day-to-day routine. What do you think? Could you or would you want to test this method? Maybe you already do. If so, how is it working for you?